The Official

Journal of

The North

Carolina

Sociological

Association: A

Peer-Reviewed

Refereed Web-Based

Publication

ISSN 1542-6300

Editorial Board: Editor: George H. Conklin, Emeritus, North Carolina Central University Robert Wortham, Associate Editor, North Carolina Central University Board: Rebecca Adams, UNC-Greensboro Bob Davis, North Carolina Agricultural and Technical State University Catherine Harris, Wake Forest University Ella Keller, Fayetteville State University Ken Land, Duke University Steve McNamee, UNC-Wilmington Miles Simpson, North Carolina Central University William Smith, N.C. State University

Editorial Assistants John W.M. Russell, Technical Consultant

Submission

Guidelines

for

Authors

Cumulative

Searchable

Index

of

Sociation

Today

from

the

Directory

of

Open

Access

Journals

(DOAJ)

Sociation Today

is abstracted in

Sociological Abstracts

and a member

of the EBSCO

Publishing Group

®

®

Volume 10, Number 1

Spring/Summer 2012

The Changing North Carolina Workplace*

by

Ian M. Taplin

Wake Forest University

and

Bordeaux Ecole du Management

In January 2012, Caterpillar Inc. tried to persuade locked-out workers in its plants in Canada to accept lower wages by citing cheaper and more pliant plants not in Mexico, or China or even South Korea but in the United States. Specifically it listed wage and benefit costs at its rail-equipment plant in LaGrange, Illinois as being less than half that of the company's locomotive assembly plant in London, Ontario (Hagerty & Linebaugh, Wall Street Journal, 1/6/2012). Behind this seemingly strange comparison lies the fact that US wage growth in the past decade has been minimal, work organization has become more flexible and increased automation results in fewer workers needed. As of 2010 U.S. manufacturing labor costs per unit of output were 13 percent lower than they were a decade earlier compared to Germany where costs have risen by 2.3 percent and Canada where the increase has been 18 percent. This means that U.S. workers have become more productive and when combined with lower energy costs (the result mainly of shale gas) and a weaker dollar, U.S. based manufacturing has become more attractive. By bringing back some work that had been outsourced to Asia, many firms have been able to avoid logistical problems as well as benefit from enhanced levels of production flexibility that domestic manufacturing now permits. A $1.1 billion investment by Bridgestone Corp. of Japan to both expand and build a new car tire plant in South Carolina was based upon higher productivity levels for workers in that state, thus affirming the trend of "re-industrialization."

Is this the start of a trend in which the de-industrialization of America is being reversed, albeit partially and for certain kinds of jobs? Or does it portend a change in the actual nature of manufacturing that remains? Using recent events in North Carolina I argue that the latter is occurring, against the background of the former and whilst some manufacturing jobs are returning to the United States and other new ones added, these are quite different to those of several decades ago. Specifically, the new manufacturing jobs are likely to be highly skilled, demanding educational levels between High School and College, and they are accompanied by higher levels of capital expenditures than in the past. Both combine to make workers work better and more productively, with automation replacing some worker jobs whilst complementing the operational efficiency of others. In sum we are seeing a 'new' type of worker, one who is better educated than his/her counterpart of two decades ago but who also earns less than that person did. This combination of cost and output efficiency appears to be rekindling manufacturing in many areas of the country but with quite telling signs within North Carolina.

1980s Onwards

During the late 1980s, with the exception of some of the more remote rural areas, the unemployment rate for many counties in NC was between 2 and 3 percent. Whilst the furniture and textile/apparel sectors had lost some manufacturing and the tobacco industry was undergoing restructuring and developing more overseas markets, these industries continued to maintain a strong presence in the state. In numerous small towns and rural areas, mills and furniture factories continued to take advantage of pools of semi-skilled female workers and lower overhead costs to realize rising productivity rates. Wages continued to be depressed, a function of the relative isolation of the workers (Taplin 1994; 1995). However, uneven economic growth in the state, particularly the rise of the service sector in urban areas, meant that there were increasing employment opportunities for semi-skilled workers. By the late 1980s, "help wanted" signs abounded in most urban areas. In fact, there was a shortage of skilled sewing machine operators in the Winston-Salem area as many young women who had hitherto gone into this line of work now sought opportunities in the burgeoning service sector as receptionists, telephone operators and general secretaries. The pay was not necessarily better than the manufacturing sector but it had the appeal of not being a "traditional industry," hence perceived as a more desirable career path for a 'progressive' young woman. As a consequence, some of the subsequent decline in apparel manufacturing employment can be explained by a shortage of workers (at least at the pay levels firms were prepared to offer).

By the early

1990s however, secular employment decline in these traditional industries

was increasing, as work was shifted offshore, first to Mexico and Central

America and then subsequently to Asia. The massive growth of imports from

low wage newly industrialized countries (NICs) was particularly damaging

to firms in the lower cost, mass market sector that was prevalent in the

southern United States. Their response was to seek ways of better organizing

the existing and then smaller workforce, automating production when possible,

and improving their supply chain coordination (Taplin 1994). However, this

merely served to postpone the inevitable decline and by the new millennium,

employment in these traditional industries had dropped precipitously. Textile

and apparel employment decreased by 60 percent, from 213,775 workers to

80,232 between 1996 and 2006, and the number of plants declined by 40 percent

from 2153 to 1282 (Employment Security Commission of North Carolina). Apparel

suffered proportionately more than textiles. In furniture manufacturing

the story was similar as manufacturers sought lower production costs in

China where 2004 hourly wages were $0.69 cents versus $14.24 in the United

States. (http://www.soc.duke.edu/

NC_GlobalEconomy/index.shtml ).

Agricultural Changes

Whilst traditional manufacturing jobs were disappearing from cities and small towns, rural NC was undergoing something of an agricultural revolution as certain sectors expanded with an industrial type production, others declined and new niche products have emerged. The application of mass production techniques to areas such as hog farming and poultry processing has capitalized upon the growing availability of cheap, immigrant labor which other food crops had utilized on a seasonal basis in previous years. This lessened unemployment in rural areas but it still provided mainly low wage options to the labor pool.

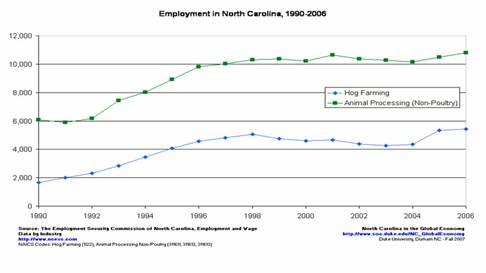

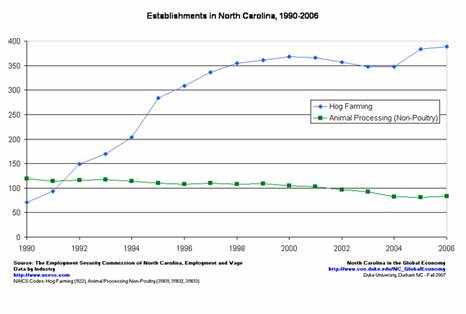

NC is currently second after Iowa in terms of hog production with much of the dramatic growth coming in the late 1990s. Much of this is concentrated in the eastern part of the state and although numbers of farms and employment has stabilized in recent years, it provides average annual wages of $30,000. Tables 1 and 2 provide details of recent trends. Poultry production has mirrored these trends albeit with higher levels of ownership concentration. Economies of scale have been key to the success of this sector as has the availability of inexpensive immigrant labor (Wahl 2007.)

One of NC's staple and traditional crops has been tobacco. Production here has declined dramatically following the settlement between the four major tobacco companies and 46 states in 1998. Prior to this date, tobacco had provided earnings of $1 billion per year for growers and sustained 30,000 jobs (Tursi et al. 2000). But following extensive litigation over product liability, eventual coordinated lawsuits by states' Medicaid systems resulted in a financial settlement whereby tobacco companies would pay the states $206 billion over 25 years and create a fund (Golden Leaf) to be used in part to help farmers diversify into alternate crops. With almost $2 billion assigned to NC farmers and allotment holders it encouraged experimentation with other crops, including grapes, strawberries, and other fruits that could be sold direct to consumers (Breckenridge and Taplin 2005).

While only 2 percent of farmers have used this fund to diversify into grape production, many in the Piedmont region sold or passed on their tobacco plots to individuals interested in wine production. In this sense there has been an indirect transfer of activities and this has been noticeably associated with the dramatic growth of wineries in the state. NC currently has the second fastest growth in wineries in the nation with currently 116 wineries, and has the most visited winery in the United States (Biltmore Estate). Much of this growth has occurred in the past decade and is centered primarily in the central and western part of the state (1). Although most of the wineries are small (1500-2000 case annual production) there has been a significant economic impact ($1.28 billion in 2011), with 7600 jobs and 1.26 million wine tourists (http://tinyurl.com/NCwinestudy). It has helped create a new agricultural identity for the state, and made a small but nonetheless important contribution to rural transformation (Taplin 2011; 2012). Many small holder farms have become grape producers as suppliers to wineries, further consolidating production of higher value added products similar to that played by tobacco in the past. Figure 1 provides details of the recent growth surge in the number of wineries.

Return of Manufacturing?

In the earlier part of the paper I alluded to changes in the manufacturing sector as semiskilled jobs were lost when firms relocated production overseas. This trend was not dissimilar to what was occurring nationwide. In the past decade the US lost 25 percent of its manufacturing jobs and even though areas in the rust belt were often the hardest hit (Pennsylvania, Ohio and Michigan lost, respectively, 28, 29 and 35 percent), NC experienced the trend with the decline of furniture and apparel/textiles. However, in recent years the US has seen the fastest growth in manufacturing than in any other leading developed economy. Falling unit labor costs – associated with subdued wages –, productivity growth, and a steady decline in the value of the dollar since 2002 have made domestic manufacturing more and more viable. In addition, rapid pay inflation in developing economies has made outsourcing less and less attractive, especially when considering the continued logistical problems that can accompany such action. For example, in 2000 the average wage in China was 50 cents an hour, now it is $3.50. Lower productivity rates for Chinese workers erodes the competitive price advantage of outsourcing and has resulted in more US firms bringing some production, especially of higher value-added products, back to the United States.

The new factory however, is quite different from the old one where legions of semi-skilled workers toiled on mass production assembly lines. It is now much more likely to be characterized by advanced technology, higher rates of automation, and greater application of capital to enhance workers efficiency. In sum, it is a more sophisticated work place requiring fewer, but highly skilled workers. Emphasis is now placed on higher levels of mathematic and reading ability than in the past since the new machines require interpretive interaction. But this comes at a time when many firms had eschewed in-house training and vocational training at High Schools has been significantly diminished. For High School dropouts the situation is truly bleak as their career avenues have been significantly diminished. The result has been a shortage of workers with skill sets that fall somewhere between high school and college. A recent nationwide poll indicated that 52% of employers report difficulty filling jobs and 47 percent blame prospects' lack of "hard" job skills or technical skills for not hiring them. This has also resulted in significant trends in unemployment rates with less than 40 percent of 25 million Americans over age 25 without a high school diploma actually employed (Ansberry, Wall Street Journal, February 25, 2012). The one third of NC workers who have been unemployed for more than a year figure disproportionately in this group, many of whom have dropped out of the labor market permanently. Furthermore, when working this group earns less than their high school graduate counterparts; respectively $24,400 on average compared with $33,500.

Previous manufacturing employment relied upon legions of high school graduates to assume low end factory work where cognitive skills were minimal and technical skills could be easily learned on the job. This type of preparation is no longer the case. Workers who held such jobs in the past and that have become unemployed as a result of lay-offs frequently find work difficult to attain because of skill atrophy. In addition, jobs such as construction that traditionally employed less educated American men, have declined precipitously in recent years. Concurrent with these trends service sector work continues to be low wage and low skilled, the only significant exception to this being in nursing.

NC Employment Growth Areas

Ironically it is precisely in many of the traditional industries that a manufacturing resurgence has occurred. In the furniture industry, not too long ago consigned to virtually disappearing from the United States except for high end, custom products, the number of establishments declined by 10 percent since 1996 whereas employment fell by over 40 percent. Despite this continued decline, the jobs that remain have been refocused upon design, marketing and high end products – all of which require more skilled workers but incorporate high value added tasks. For example, Lincolnton Furniture Company had employed 1000 workers in the early 1980s but was forced to close its factory in 1996 as production moved to Asia. But with higher labor and shipping costs in that part of the world, plus potentially higher productivity of NC workers, the competitive advantage of Asian manufacturing was disappearing. In 2011 the factory reopened in NC with a focus upon high quality wooden products including beds, tables, chairs and cabinets.

In textiles there is a similar story. Unifi, located just west of Winston-Salem, was traditionally a high volume supplier of commodity polyester and nylon filament yarns to the US and European textile sector. Following the outsourcing of much of this production to Asia by the late 1990s, the firm underwent restructuring and downsized. In recent years it has become a specialist yarn supplier with a focus upon recycled product capacity with its 'Repreve' brand. Its Yadkinville plant was reorganized in May 2011 and a flexible modular manufacturing system was introduced. This provided enhanced efficiency for its economies of scale operations for recycled products as the firm essentially reinvented itself as a technologically advanced textile manufacturer with a focus upon niche, high value added or proprietary products. It relies upon a core workforce of skilled workers, many of whom went through extensive company re-training programs. The company views the skilled workforce as providing a competitive edge in the marketplace and relative to other companies in the area provides generous benefit packages.

Burlington Technologies, Inc., a manufacturer of specialty textiles, is also adding jobs, this time as a consequence of a contract with the US military. It too has upgraded its specialist manufacturing capability and focused upon niche products (Winston-Salem Journal, February 18th 2012). By adding 110 jobs and spending $725,000 on capital investments over the next three years it is eligible for a $120,000 grant from the One North Carolina Fund. Local government incentive packages are not new and have been used extensively in the state to attract business (cf Dell manufacturing, Apple and most recently Caterpillar) but in this case it was a matching incentive that was tied with jobs with upgraded skill levels.

Finally, in Charlotte Siemens is undergoing a $135 million expansion at it manufacturing facility. It plans to add 800 jobs, mostly machinists, welders and mechanical assemblers. These are primarily skilled and require an ability to read sophisticated blueprints and possess key engineering skills. The company has partnered with Central Piedmont Community College to help train workers, placing them on the payroll whilst undergoing training as well as providing funding for training of instructional staff. Despite these efforts, the company has only been able to add 100 new workers and has suspended hiring for skilled assemblers.

This shortage of skilled workers is emblematic of the problems facing many manufacturers who are bringing skilled work back to the US but frequently lament the limited labor pool in this category. Current estimates indicate that there are 600,000 skilled manufacturing jobs nationwide that are unfilled because of worker skill mismatches. In the past firms have been reluctant to train recently hired workers because it was feared that they would then leave the jobs following completing of the training for better paid work elsewhere. But the growing crisis of skill shortages in areas such as machinists and robotics specialists is prompting some firms to rethink this policy. In part they have been inspired by foreign firms who are more likely to embrace vocational training for their workers because of labor market policies that have institutionalized this in their home countries. Volkswagen AG has introduced German style apprentice training programs at its new Chattanooga, TN plant to ensure workers have the necessary skill sets to maintain and trouble-shoot robotics and assembly-line systems (Fuhrmans, Wall Street Journal, June 14, 2012). In South Carolina Robert Bosch GmbH and BMW set up successful training programs with local community colleges because of an initial lack of appropriately skilled workers in areas of welding, machining and the maintenance of high technology gear.

There are 200 foreign firms in the Charlotte area who comprise most of the 18 that are working with the local community college (Central Piedmont Community College) in company-tailored apprenticeship partnerships to train workers. Siemens is currently spending $165,000 an apprentice for its three year mechatronics training program to ensure it has an adequate supply of skilled workers for its manufacturing capability expansion plans. However, there are indications that American firms have taken note and are experimenting with such programs. Carolina CAT is a Charlotte-based heavy equipment manufacturer that has adopted a technician training program in which it sponsors students for 12 months at the Community College followed by eight weeks of on-the-job training at the plant (Fuhrman, Wall Street Journal, 14 June, 2012). Upon successful completion of the training all of the workers are guaranteed jobs at the company.

Certain regions in NC have also embraced bio-technology as an alternative to the traditional manufacturing sectors. Centered around hospitals (e.g. Duke University Medical Center and Wake Forest University's Baptist Hospital), this development has been predicated on entrepreneurial start-ups and the spinning off from medical research. For example, in February 2012 WFU's Biotech place opened in a converted downtown tobacco mill. Designed as a central space for research into a wide range of health related innovations it will eventually employ 450 skilled workers/researchers when full. The aim is to create new sectors of skilled jobs in fields that will see continued expansion and facilitate the transition from a manufacturing based economy to one that is high tech and health related.

Aside from nursing, this is perhaps one of the few areas of service sector, high skilled, high wage job growth in the state. Since the financial crisis of 2008 the state's banking industry has been hit hard and lay-offs continue. Health related industries are seen as a cornerstone for future economic growth although as some municipalities are discovering such growth accompanied by manufacturing decline is something of a double edged sword. As city financial managers in Winston-Salem recently noted, the old industries of textile, tobacco and furniture generated property tax revenues for the city in addition to jobs; the new health care industries are predominantly non-profit, hence provide minimal tax income for the city, yet the demand for infrastructure services remain the same (Winston-Salem Journal, 5 June 2012).

Is There a Manufacturing

Future for NC?

Many pundits argue that what we are seeing nationally is a jobless recovery, with companies investing to upgrade factories but only slowly adding workers (Aeppel, Wall Street Journal, January 17, 2012). Given productivity trends and the benefits of software systems that permit more efficient workplace practices with fewer workers, short run gains come at the expense of employment, particularly for displaced workers. With the economy growing since 2009, capital expenditures have increased by 31 percent, but private sector jobs by a mere 1.4 percent. The accelerating use of technology has resulted in some jobs replaced with automation, some sent offshore and depressing pay for others and forcing them into marginalized, part-time work (Water, Financial Times, 16 December 2011). In past recoveries, technological innovations led to employment growth but this has yet to happen at the present. In specific jobs in certain industries, however, there continues to be a skilled worker shortage that leaves employers stymied. A mismatch in skills is not unusual as industries evolve and transform but this seems to be more prescient at the moment. Furthermore, unable to hire skilled workers often results in an inability to hire less skilled workers whose jobs complement their skilled counterparts.

In NC traditional manufacturing industries have shed jobs but also witnessed job growth for skilled operatives. A leaner workforce has emerged as firms sought niche products that enable them to capitalize upon upgraded work capabilities and technological innovation. But many employers continue to lament the lack of skilled workers which raise questions about extant labor market policies in the US in which it has been assumed that individuals are responsible for their own human capital development and firms have been reluctant to embrace European-style apprenticeship programs. The growing recognition that Technical and Community Colleges can play a vital role in providing requisite training has unfortunately been constrained by budget constraints as states face fiscal problems, hampering their chance to be a vehicle for skill upgrading and worker re-training. When it has occurred, it is often because the companies themselves have underwritten much of the costs, from hiring and paying instructional staff to subsidizing workers who take the classes. To the extent that this is a broader institutional problem associated with US employment regimes and production practices that have not really met the challenge of post-Fordism is increasingly apparent. The absence of a society-wide commitment to skill upgrading limits the wider possibility of high performance workplace becoming the norm rather than the exception (see Rubery and Grimshaw 2003).

From a sociological

perspective a further question that merits consideration revolves around

workplace relations in a high skilled manufacturing workplace. Will greater

skill levels amongst workers lead to increased worker autonomy and less

managerial ability to control workers? This is certainly a trend beyond

the normal debates about workplace flexibility and the assertion of managerial

control in a post-Fordist workplace where work and workers have become

more systematized, coordinated and subject to enhanced supervisory control

(see Vallas 2012 for a further discussion of issues of workplace control).

Alternatively, in tight labor markets might skilled workers perceive the

implied security of skilled work employment and become more compliant workers?

Futhermore, as wages remain below what they had been for semi-skilled manufacturing

workers in previous decades, might the new generation of skilled workers

eventually start demanding more, both in terms of wages and benefits? These

are questions that will presumably be answered as employment relations

evolve. On one level, there continues to be positive signs that manufacturing,

albeit of a more specialist nature, is growing and adding jobs. But as

with many of the new bio-tech jobs and those associated with the growing

health care sector, the skills required are cognitively different to those

possessed by many of the displaced, often older manufacturing workers.

Re-training programs abound and are funded by state and local government

but not every laid-off worker has the capacity for high skilled work. Unskilled

jobs in the service sector (janitors, security personnel, restaurant workers)

are available but at minimum wage levels are hardly likely to re-stimulate

local economic growth and bring NC fully out of the recession. To conclude,

unfortunately job growth is often occurring in areas where the local work

force is conspicuously lacking in requisite skills. As long as firms experiment

with apprenticeship programs and in-house training, this could be less

of a problem than one might think. But not all unskilled workers have the

capacity for such work and for them, the future remains undeniably low

wage and weak.

References

Breckenridge, S and Taplin, Ian M. 2005 "Entrepreneurship, Industrial Policy and Clusters: The Growth of the North Carolina Wine Industry." Research in the Sociology of Work 15:209-320.

Rubery J and Grimshaw, D. 2003 The Organization of Employment. Palgrave: Basingstoke, England.

Taplin, Ian M. 1994 "Recent Manufacturing Changes in the US Apparel Industry: The Case of North Carolina." in Bonacich, E., Cheng, L., Chincilla, N, Hamilton, N. and Ong, P. Global Production Temple University Press: Philadelphia, pp328-344.

----------------- 1995 "Flexible Production; Rigid Jobs: Lessons from the Clothing Industry." Work and Occupations 22/4:412-438.

------------------2011 The Modern American Wine Industry. Pickering and Chatto: London.

----------------- 2012 "Innovation and Market Growth in a New 'New World' Wine Region: The Case of North Carolina." Journal of Wine Research 1/1-18.

Tursi, F, White, S.E. snd McQuilkin, S. 2000 Lost Empire: The Fall of RJ Reynolds Tobacco Company (Winston-Salem Journal: Winston Salem).

Vallas, S. 2012 Work. Polity: Cambridge, England.

Wahl, A-M. 2007 "Southern (Dis)comfort?: Latino Population Growth, Economic Integration and Spatial Assimilation in North Carolina Micropolitan Areas." Sociation Today 5:2.

Footnotes

*This is based on the presidential address given at the North Carolina Sociological Association annual meeting, Winston-Salem, NC February 2012.

(1) Duplin winery

is actually the largest in terms of case volume but its production of sweet

muscadine wine and location in the eastern part of the state means it operataes

more in a niche market.

Return to Text

Return to Sociation Today Spring/Summer

2012

©2012 by Sociation Today